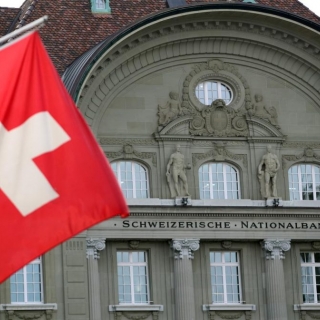

The Swiss National Bank cut its interest rate by 50 basis points on Thursday, the biggest reduction in almost 10 years as it sought to stay ahead of expected cuts by other central banks and cap the rise of the Swiss franc.

The SNB reduced its policy rate from 1.0% to 0.5%, the lowest since November 2022.

While markets had predicted the move, more than 85% of economists polled by Reuters had expected a smaller cut of 25 basis points.

It is the steepest drop in borrowing costs since the SNB's emergency rate cut in January 2015 when it suddenly quit its minimum exchange rate with the euro.

"Underlying inflationary pressure has decreased again this quarter. The SNB's easing of monetary policy today takes this development into account," the SNB said.

"The SNB will continue to monitor the situation closely, and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term."

Thursday's decision was the first under new SNB Chairman Martin Schlegel, and saw an acceleration from the policy of predecessor Thomas Jordan, who oversaw three reductions of 25 basis points this year.

It was made possible by weak Swiss inflation, which was 0.7% in November, and has been within the SNB's 0-2% target range, which it calls price stability, since May 2023.

The European Central Bank is also expected to cut rates later on Thursday and the U.S. Federal Reserve on Dec. 18.

The Bank of Canada cut its main policy rate by 50 basis points on Wednesday.

Narrowing interest rate differentials between Switzerland and other countries increase the attractiveness of the safe-haven franc, boosting the currency.

The franc's appreciation is an additional headache for Swiss exporters, making their exports more expensive when they are already facing subdued demand in Europe and China.

"Low inflation and risks to the European economy and thus to the Swiss economy may have been major drivers for this rate cut," said UBS economist Alessandro Bee.

"Furthermore, by cutting by 50 basis points the SNB is likely to widen the interest rates differential and thereby pre-emptively counter excessive Swiss franc strength."

The SNB now expects growth of between 1% and 1.5% for 2025. It had previously predicted 1.5% for next year.

The central bank expects inflation to remain within its target range. For 2024, the SNB sees Swiss prices rising by 1.1%, by 0.3% in 2025 and 0.8% in 2026.

This compared with its previous forecast for inflation at 1.2% this year, 0.6% in 2025 and 0.7% in 2026.

Source : Reuters

The Bank of Japan held its benchmark interest rate steady and raised its inflation outlook more than expected in a sign it may be closer to a rate hike, while continuing to warn that it's still assess...

Economy is in a solid position.Inflation is somewhat above target.Believe the current stance of policy leaves us well positioned to respond in a timely way.Moderation in growth reflects a slowdown in ...

The Federal Reserve left the federal funds rate steady at the 4.25%–4.50% target range for a fifth consecutive meeting in July 2025, in line with expectations. Policymakers noted that although swings...

Federal Reserve Governor Christopher Waller said on Thursday he continues to believe the U.S. central bank should cut interest rates at the end of this month amid mounting risks to the economy and the...

The emerging divide among Federal Reserve officials over the outlook for interest rates is being driven largely by differing expectations for how tariffs might affect inflation, a record of policymake...

The Australian Dollar (AUD) remains under pressure against the US Dollar (USD) on Friday, giving back most of its earlier gains despite broad weakness in the Greenback following a disappointing Nonfarm Payrolls (NFP) data. The AUD/USD initially...

Oil prices $2 a barrel on Friday because of jitters about a possible increase in production by OPEC and its allies, while a weaker-than-expected U.S. jobs report fed worries about demand. Brent crude futures settled at $69.67 a barrel, down $2.03,...

The yen has suffered a difficult month, but BCA Research thinks the Japanese currency is primed for a multi-year rally. At 08:30 ET (12:30 GMT), USD/JPY traded 0.2% lower at Y150.49, having earlier in the session climbed as high as Y150.91, the...

Annual inflation in the United States (US), as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, rose to 2.6% in...

Annual inflation in the United States (US), as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, rose to 2.6% in...

Asia-Pacific markets traded mixed Thursday as investors assessed the U.S.′ blanket 15% tariffs on imports from South Korea and awaited details on...

Asia-Pacific markets traded mixed Thursday as investors assessed the U.S.′ blanket 15% tariffs on imports from South Korea and awaited details on...

According to a report from the US Department of Labor (DOL) released on Thursday, the number of Americans filing new applications for unemployment...

According to a report from the US Department of Labor (DOL) released on Thursday, the number of Americans filing new applications for unemployment...

The pan-European Stoxx 600 index provisionally closed just below the flatline on Wednesday, with sectors diverging as second quarter earnings season...

The pan-European Stoxx 600 index provisionally closed just below the flatline on Wednesday, with sectors diverging as second quarter earnings season...